Unlike proof-of-stake cryptocurrency protocols that directly provide rewards for locking staked tokens, “staking” FIL is much more akin to a lease.

You may have heard of services or applications that enable “Filecoin staking.” However, “staking” on the Filecoin network is different from proof-of-stake cryptocurrency protocols like Ethereum. Filecoin “staking” allows storage providers (SPs) to borrow FIL which they use as collateral to provide storage on the Filecoin network.

Unlike proof-of-stake cryptocurrency protocols that directly provide rewards for locking staked tokens, “staking” FIL is much more akin to a lease. SPs borrow FIL to use as collateral and may pay a fee. Applications facilitating this may also take a fee.

You can think of a FIL lease to a storage provider like a car being leased to an Uber driver who makes money providing rides through the Uber platform. During the lease term, the car owner receives lease payments from the Uber driver; when the lease is over, the car is returned to the owner.

Why do storage providers need FIL collateral?

Filecoin storage providers (SPs) contribute data storage capacity to the Filecoin network.

In order to ensure that files are stored reliably over time, SPs are required to post FIL as collateral. If an SP fails to meet their responsibilities (perhaps they go offline or stop storing certain files) their collateral is slashed, meaning that they lose a portion of the FIL they posted as collateral.

A storage provider can buy or earn FIL to provide the collateral they need to run their data storage business, or they might borrow/lease FIL from existing token holders.

Centralized vs decentralized applications

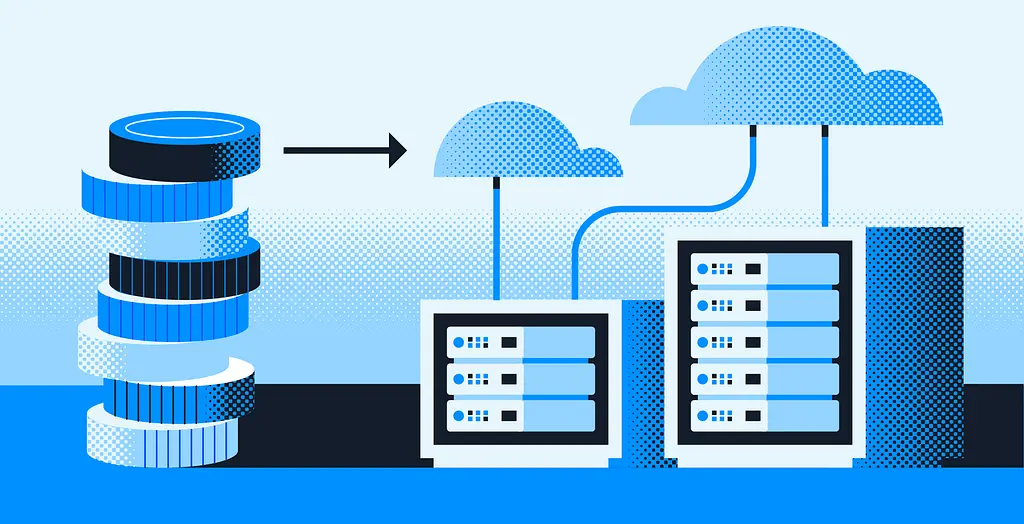

Third-party centralized programs enable storage providers to borrow FIL to use as collateral. In the centralized model, token holders transfer custody of their FIL to centralized intermediaries for set periods of time. These intermediaries allow SPs to borrow FIL, and distribute fees collected to token holders.

This model requires that token holders trust the centralized intermediary with custody of their FIL. Some centralized programs rely on multi-sig transactions. Multi-sig is short for ‘multi-signature’, which means a transaction has two, or more, signatures before it is executed. However, multi-sigs still rely on human intervention.

In contrast to this centralized model, there are also numerous decentralized third-party applications that utilize smart contracts to enable SPs to borrow FIL to post as collateral.

Risk

Using any third-party application carries risks, and it is critical to thoroughly research any application to understand all these risks. Some areas to consider are:

- Audits: Has a third-party audited the code and are the results published publicly?

- Open Source: Is the code available to inspect publicly?

- Bug Bounty: Does the program provide a bug bounty to incentivize anyone to report/fix possible vulnerabilities?

- Trustless: Can you use the application without relying on an intermediary; is there a single point of failure?

More information on risk is available here.

Disclaimer: This information is for informational purposes only and does not constitute investment, financial, legal, or other advice. This information is not an endorsement, offer, or recommendation to use any particular service, product, or application.