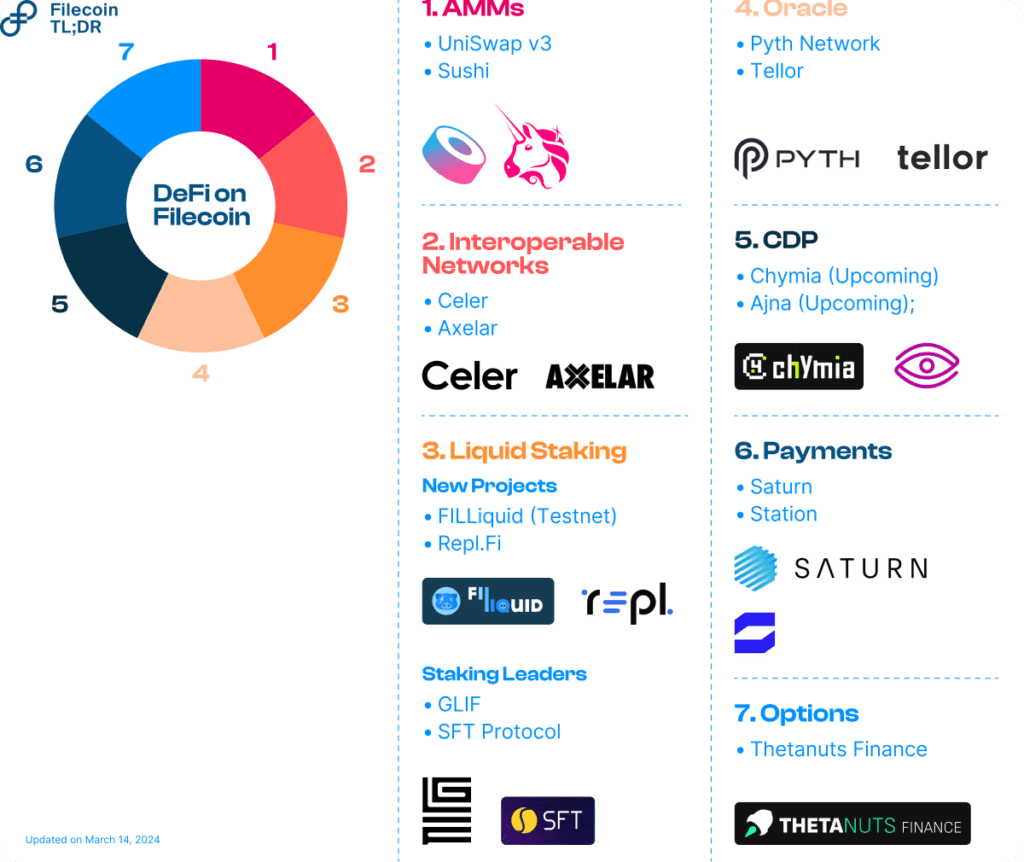

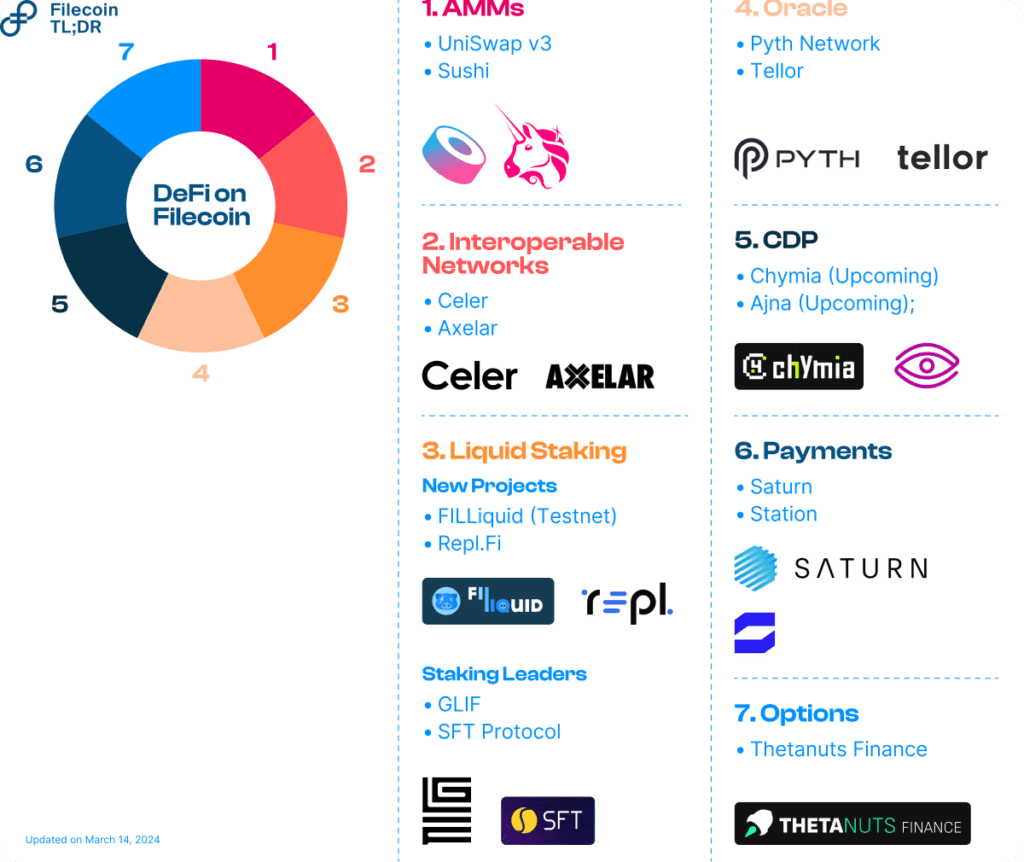

The Filecoin community celebrated the first anniversary of the Filecoin Virtual Machine (FVM) launch on March 14, 2024. The FVM has brought programmability to Filecoin’s verifiable storage and opened up a unique DeFi ecosystem anchored around improving on-chain collateral markets. Liquid Staking, for example, as a subset of Filecoin DeFi, has hit over $500 million in TVL. As the network grows, several critical infrastructures across AMMs, Bridges, Oracles, and Collateral Debt Positions (CDPs) are coming together to propel DeFi expansion in 2024.

In this blog post, let’s take a look at the latest DeFi projects launched on top of FVM and provide a view into future areas of activity.

DeFi Developments on FVM

Automated Market Makers

Automated Market Makers (AMMs) connect Filecoin with other Web3 ecosystems, enabling on-chain swaps, deeper liquidity, and fresh LP opportunities.

Decentralized Exchanges: ✅

Recently, leading Decentralized Exchanges Uniswap v3 (via Oku.trade) and Sushi integrated with Filecoin by deploying on the FVM. Oku Trade’s interface enables Uniswap users to easily exchange assets and provide liquidity on Filecoin. With this, FVM developers can effortlessly access bridged USDC and ETH assets natively on the Filecoin network, broadening Filecoin’s reach. As a foundational DeFi primitive, DEXes also opens the floodgates for non-native applications to leverage Filecoin’s robust storage and compute hardware.

Interoperability Networks

Bridges: ✅

Bridges help bring liquidity into DEXs and AMMs on FVM. For developers building on FVM, Bridges connects Filecoin’s verifiable data with tokens, users, and applications on any chain, ensuring maximum composability for DeFi protocols. For this purpose, messaging, and token bridging solutions by Axelar and Celer were added to the Filecoin network immediately post-FVM launch.

Today, AMMs Uniswap v3 and Sushi along with several other DeFi applications are natively bridged to Filecoin with the help of cross-chain infrastructure enabled by Axelar and Celer.

Liquid Staking

Liquid Staking protocols have been the prime mover within Filecoin DeFi. They’ve played a vital role in growing and improving on-chain collateral markets. Today, nearly 17% of the total locked collateral (approx. 30 million FIL) by storage providers comes from FVM-based protocols such as GLIF (52%), SFT Protocol (10%), Repl (9%) and the rest (29%). These protocols have increased capital access to storage providers while simultaneously enabling better yield access to token holders. Read more to learn how Filecoin staking works.

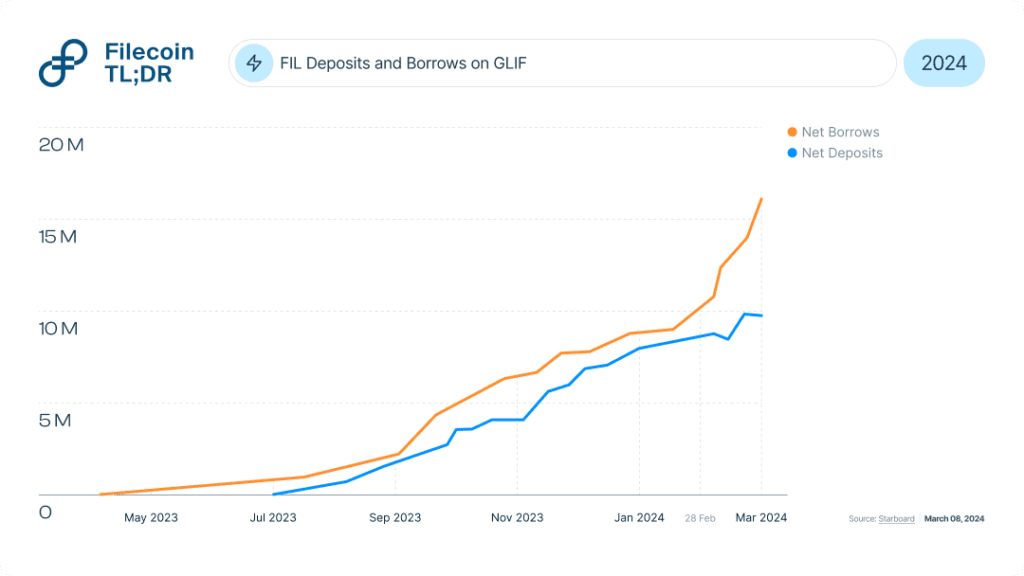

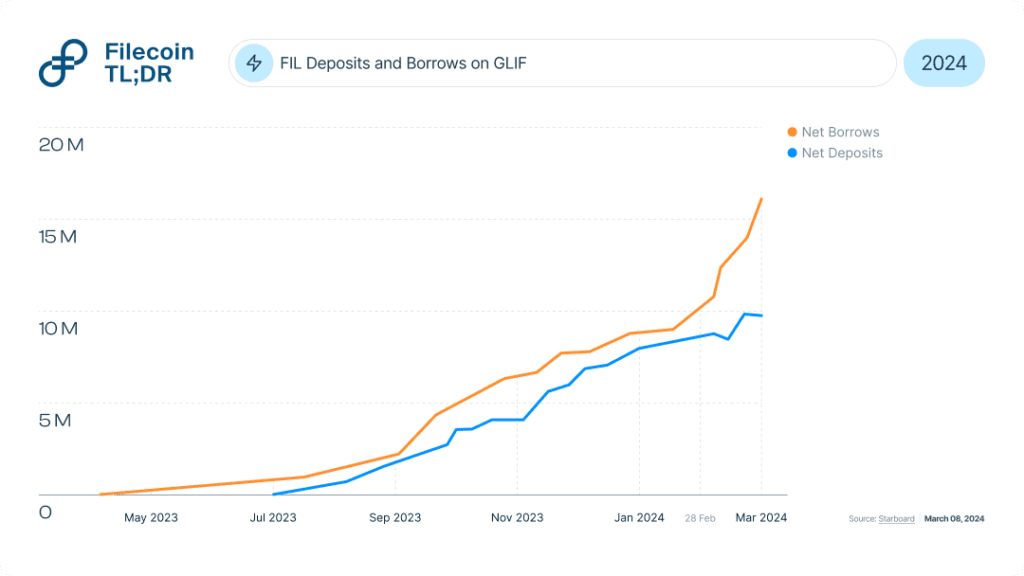

GLIF Points: 🔜

GLIF, the leading protocol on Filecoin, has a TVL of over $250 million. To put this into context, this surpasses the largest Liquid Staking protocols on L1 chains like Avalanche. As of writing this (March 06, 2024), 32% of all FIL stakes into GLIF liquidity pools were deposited shortly after its announcement to launch GLIF points (on Feb. 28, 2024), a likely precursor to a governance token.

Typically, to participate in the rewards program, GLIF users will have to deposit FIL and mint GLIF’s native token, iFIL. Similarly, the SFT protocol launched a points program in 2023 based on its governance token to incentivize community participation.

Overall, we look forward to how the gameplay of points, popular among DApps in Web3 ecosystems, will act as a catalyst to decentralize governance and incentivize participation for Filecoin’s DeFi DApps.

New Staking Models: 👀

The influx of protocols experimenting with new models to inject liquidity into the ecosystem hasn’t slowed down. Two projects worth mentioning are Repl and FILLiquid.

- Repl.fi introduces the concept of “repledging.” Under repledging, SP’s pledged FIL are tokenized into pFIL, Repl’s native token, and used for other purposes including earning rewards. Repleding essentially increases the utility of locked assets thereby reducing opportunity costs for SPs. In just a few months after launch, Repl’s TVL has soared past $30 million.

- FILLiquid, currently on testnet, models the business of FIL lending for SPs on algorithm-based fixed fees instead of traditional interest rates. The separation of payouts from the duration of deposits is expected to nudge long-term pledging and borrowing activities from token holders and SPs respectively, saving costs and increasing efficiency.

Price Oracles

Oracles, services that feed external data to smart contracts, are critical blockchain infrastructure essential for DeFi applications to grow and interact with the real world.

Pyth Network: ✅

Pyth recently launched its Price Feeds on the FVM. The integration allows FVM developers to access more than 400 real-time market data feeds while exploring opportunities to build on top of Filecoin’s storage layer. DeFi apps benefit from Pyth’s low-latency, high-fidelity financial data coming directly from global institutional participants such as exchanges, market makers, and trading firms.

Filecoin is also supported by Tellor, an optimistic oracle that gives FVM-based applications access to price feed data.

Collateralized Debt Positions

As DeFi activity on Filecoin is climbing, Collateralized Debt Positions (CDPs) will add more dimensions for other decentralized applications to build on FVM.

Chymia.Finance: 🔜

Chymia is an upcoming DeFi protocol on FVM. With a growing number of Liquid Staking Tokens (LST) on Filecoin, CDPs will extend the utility of locked tokens by generating stablecoins. Through Chymia, holders of LST can generate higher yields while using it as collateral for deeper liquidity.

Ajna: 🔜

Ajna is a noncustodial, peer-to-pool, permissionless lending, borrowing, and trading system requiring no governance or external price feed to function. As a result, any ERC20 on the FVM will be able to set up its own borrow or lend pools, making it easier for new developers to build a utility for their protocols.

Payments

Adjacent to storage offering on Filecoin, the FVM allows developers to bind DeFi payments to real-world primitives on the network. Built intuitively, Filecoin’s core economic flows enable paid services to settle on-chain. Station and Saturn are two notable Filecoin services to have successfully leveraged FVM for payments.

Filecoin Station: ✅

Station is a downloadable desktop application that uses idle computing resources on Station’s DePIN network to run small jobs. Participants in the network are rewarded with FIL earnings. Currently, Station operates the Spark and the Voyager modules, both aimed at improving retrievability on the network. In February, roughly 1,900 Station operators were rewarded with FIL for their participation.

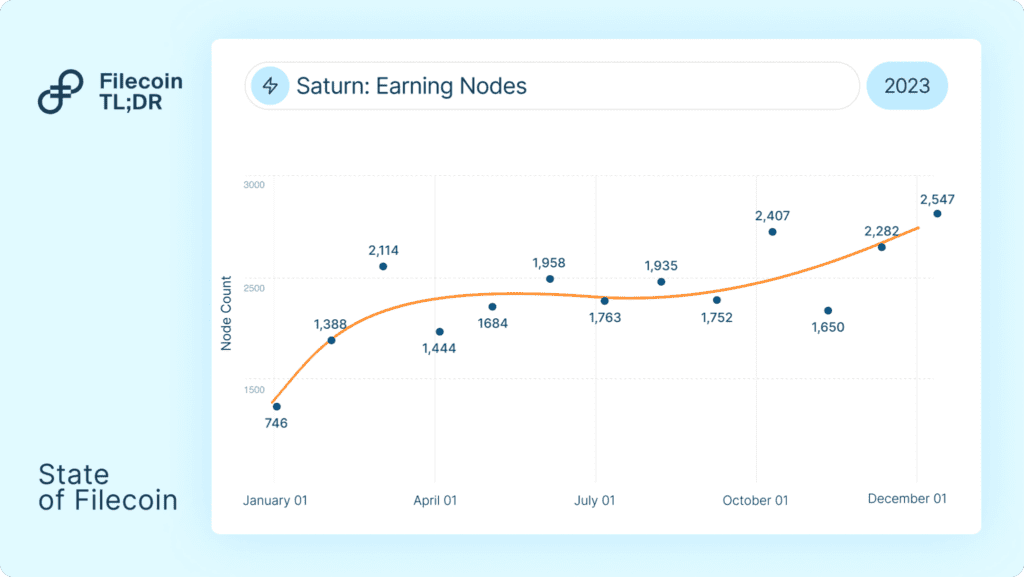

Filecoin Saturn: ✅

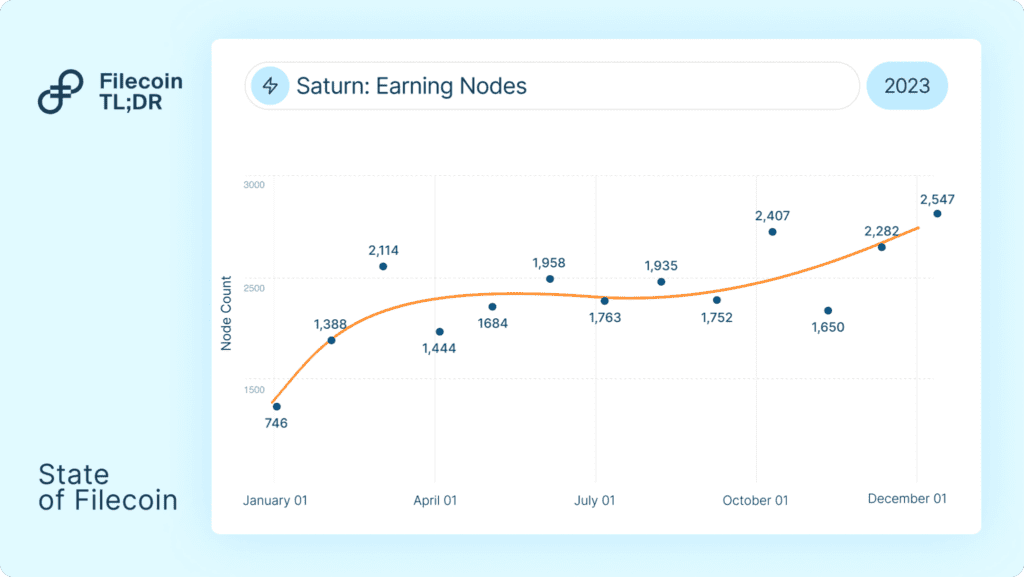

Saturn, a decentralized CDN network built on Filecoin, also leverages FVM for disbursing FIL payments to retrieval nodes on the network. In 2023, Saturn averaged over 2,000 earning nodes (retrieval providers on the network receiving FIL) for their services.

Decentralized Options

With growing liquidity, options are yet another emerging product in DeFi. Options facilitate the buying or selling of assets at a predetermined price on a future date, giving token holders protection against price volatility and an opportunity to speculate on market moves.

Thetanuts: ✅

Currently, Thetanuts Finance, a decentralized on-chain options protocol supports Filecoin. The platform allows FIL holders to earn yield on their holdings via the covered call strategy. Thetanuts FIL-covered call vaults are cash-settled and work on a bi-weekly tenor.

Wallets

To use dApps on the FVM, users would be required to hold FIL in a f410 or 0x type wallet address. Over time, many Web3 wallets such as MetaMask, FoxWallet, and Brave have started supporting 0x/f410 addresses. MetaMask also supports Ledger. With this, it is possible to hold funds in a Ledger wallet and interact with FVM directly.

In addition, exchanges like Binance natively supporting the FEVM drastically reduce complexities for FVM builders. To learn more about the most recent wallet upgrades, visit the Filecoin TLDR webpage.

What’s Next?

The obvious near-term impact of various integrations across AMMs, Bridges, and CDPs is a fresh influx of liquidity into the Filecoin ecosystem. Liquidity begets deeper liquidity with an increase in the number and diversity of DeFi protocols on Filecoin. DeFi’s growing economy clubbed with more services coming on-chain and utilizing FVM for payments will overall increase the revenue and utility of the network. We expect this strong DeFi traction to scale Filecoin as an L1 ecosystem, with core services of storage and compute becoming the backbone of the decentralized internet.

To stay updated on the latest Filecoin happenings, follow the @Filecointldr handle.

Many thanks to HQ Han and Jonathan Victor for reviewing and providing valuable insights and to all the ecosystem partners and teams for their timely input.

Disclaimer: This information is for informational purposes only and is not intended to constitute investment, financial, legal, or other advice. This information is not an endorsement, offer, or recommendation to use any particular service, product, or application.